modified business tax nevada due date

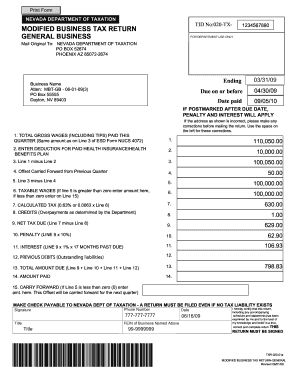

How you can complete the Nevada modified business tax return form on the web. Their hours are 7am to 7pm Monday through Friday.

1040 2021 Internal Revenue Service

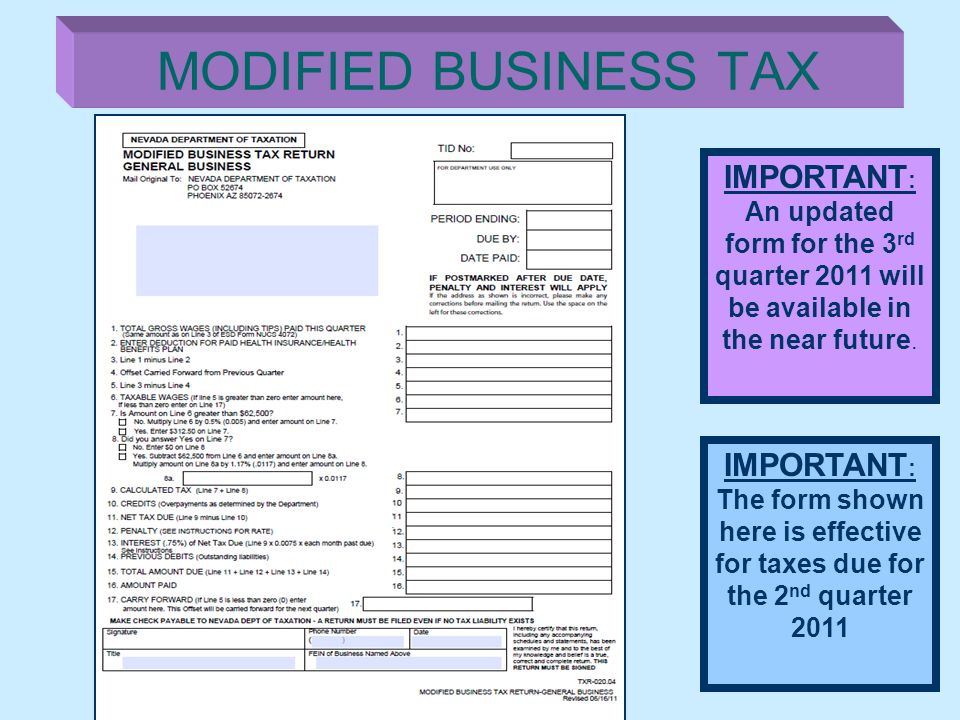

Nevada levies a Modified Business Tax MBT on payroll wages.

. Q1 Jan - Mar April 30. The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries. Add the relevant date.

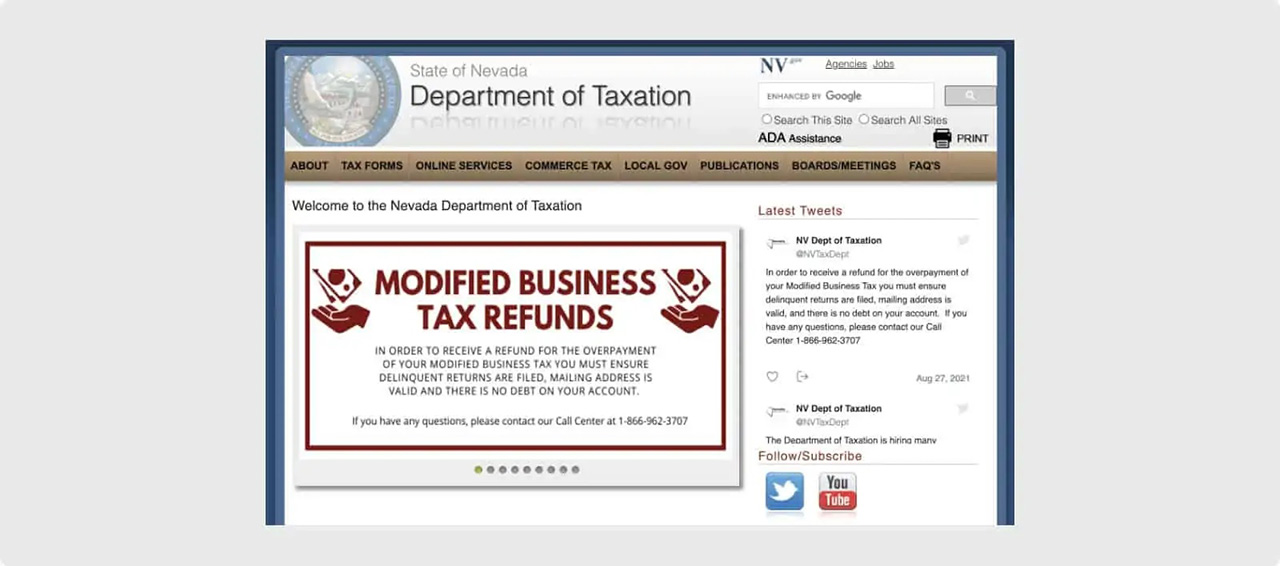

All businesses that are subject to the MBT must file a return and remit the tax to the state. The MBT is used to fund the states business activity tax credit. Our solution allows you to take the.

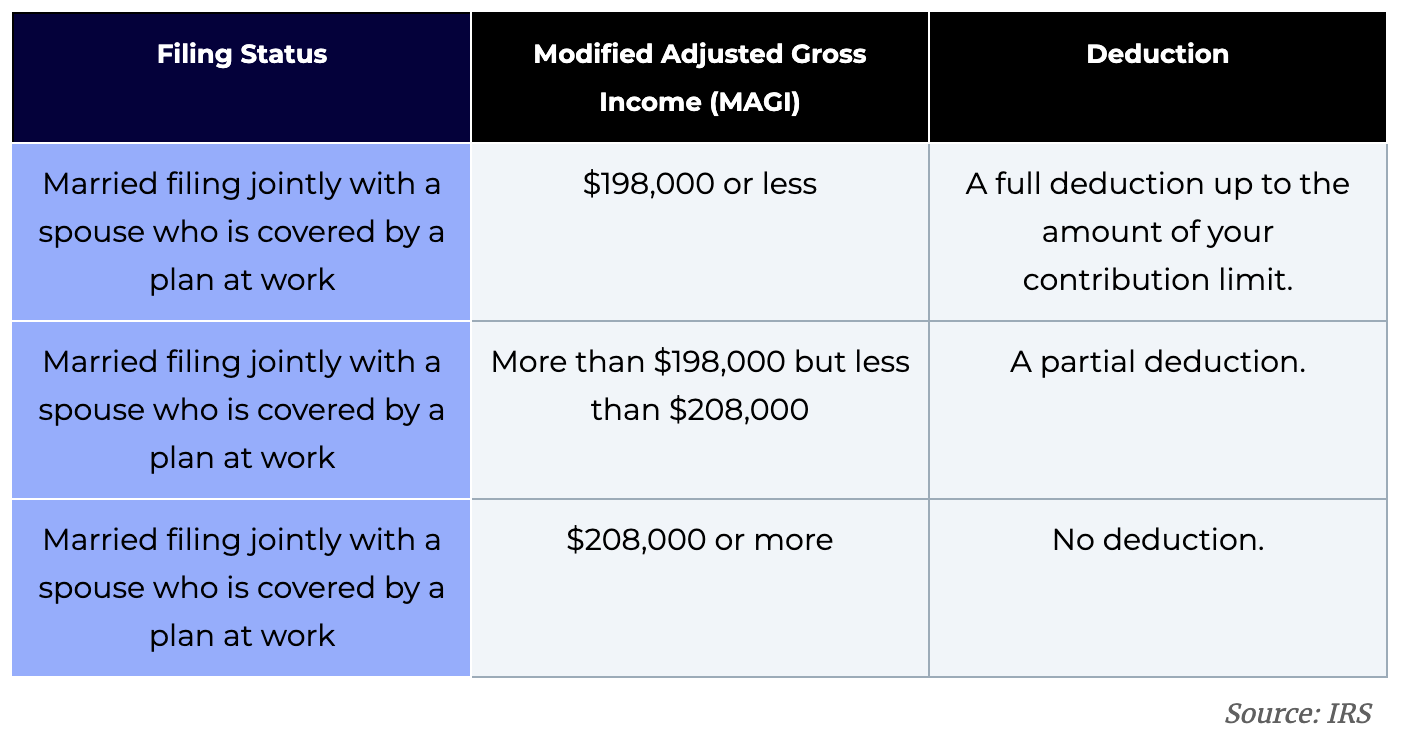

It requires data and information you should have on-hand. 12 rows Due Date Extended Due Date. If you have any questions about federal taxes you can contact the IRS at 800-829-4933.

The Nevada Modified Business Return is an easy form to complete. The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019. The 31st Special Session of the Nevada Legislature enacted Senate Bill 3 which provides for a one-time tax amnesty program for businesses or individuals doing business in.

Gross wages payments made and individual employee. Q2 Apr - Jun July 31. The Nevada Department of Taxation has sent out the first round of refund checks to businesses that paid a tax recently struck down by the states Supreme Court as being.

Complete Nevada Modified Business Tax 2020-2022 online with US Legal Forms. Sign Online button or tick the preview image of the blank. Forms and payments must be mailed to the address below.

The due date for filing. If your company paid Nevada Commerce Tax and has its payroll concentrated outside Nevada it should consider filing a refund claim for the tax year ended June 2019 by the. Nevada modified business tax due dates by Jan 24 2021 cartoon concept science The 2011 Legislative Session pursuant to AB 561 eliminated the Modified Business Tax on any General.

Easily fill out PDF blank edit and sign them. To get started on the blank use the Fill camp. This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the tax on the Net Proceeds of Minerals imposed pursuant to.

The default dates for submission are April 30 July 31 October 31 and January 31. Federal State Contact Information.

Nevada Commerce Tax What You Need To Know Sage International Inc

2022 Federal Tax Deadlines For Your Small Business

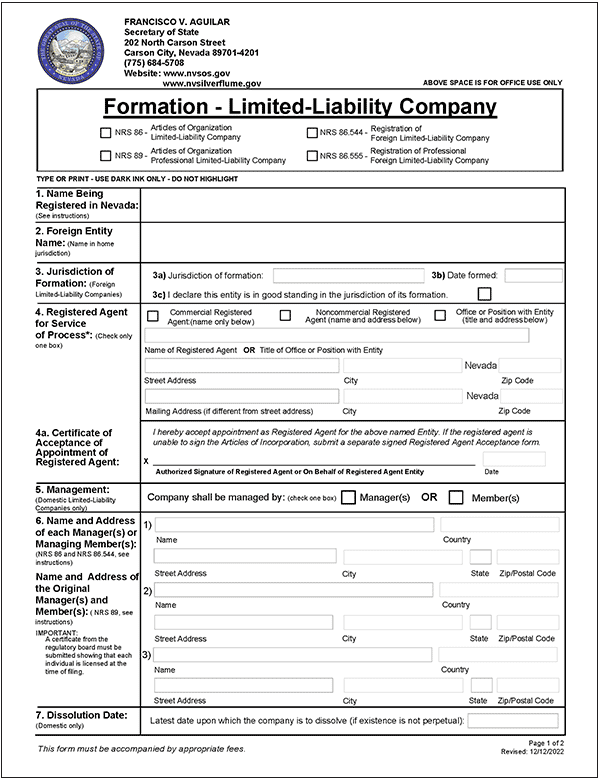

Start An Llc In Nevada 6 Step Guide For Registering An Llc

Does Qb Offer The Nv Modified Business Tax Payroll Form

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller

Nevada Modified Business Tax Form Fill Out And Sign Printable Pdf Template Signnow

How To File And Pay Sales Tax In Nevada Taxvalet

How To Form An Llc In Nevada For 49 Nv Llc Formation Zenbusiness Inc

3 11 16 Corporate Income Tax Returns Internal Revenue Service

State Of Nevada Department Of Taxation Ppt Video Online Download

Nevada Taxes Will The Tax Man Cometh To Carson City In 2023 Nbm

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller

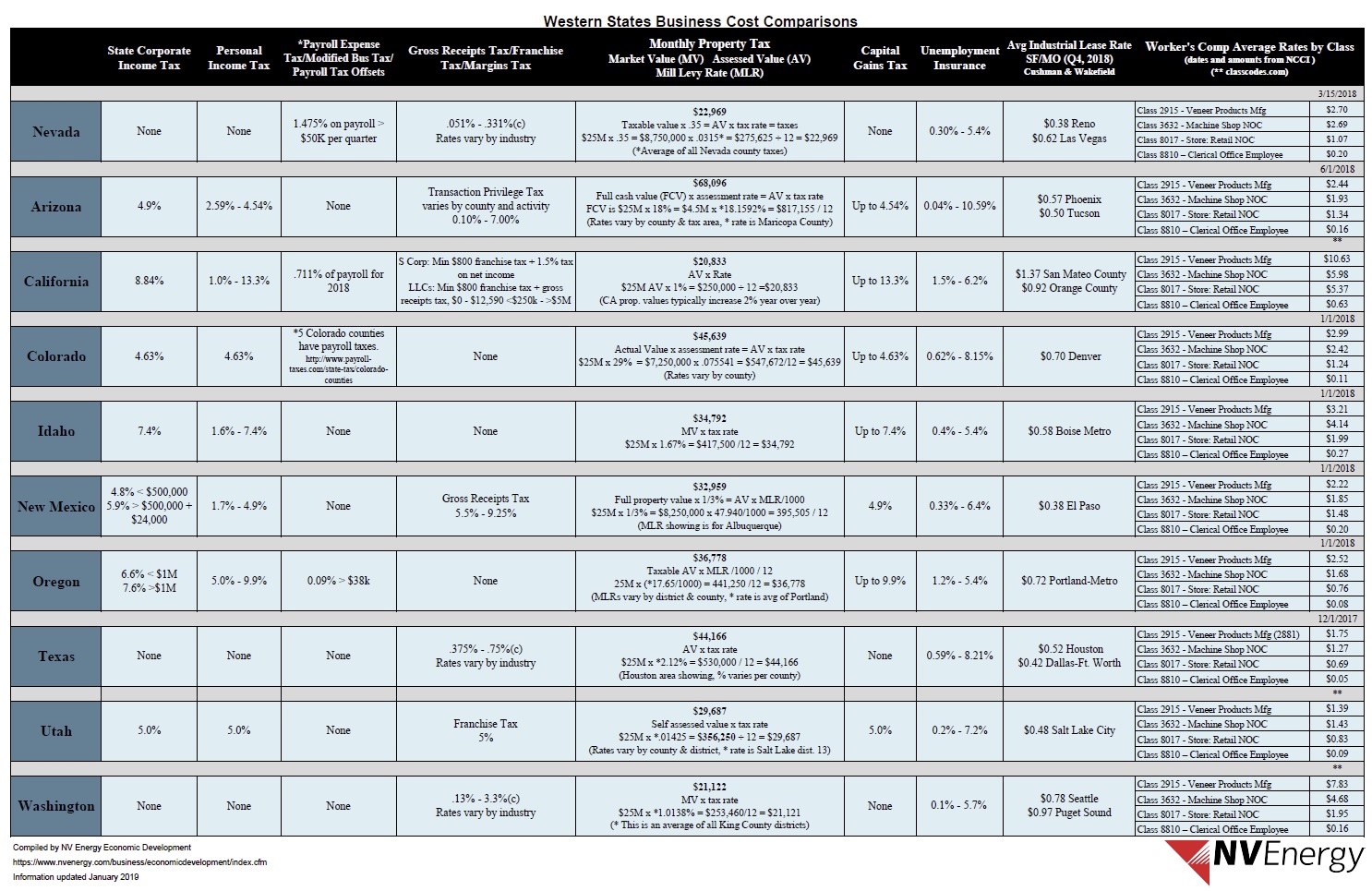

Nevada Taxes Incentives Nv Energy

How To Form An Llc In Nevada For 49 Nv Llc Formation Zenbusiness Inc

.jpg)

Https Www Nevadatreasurer Gov Ggms Ggms Home

Nevada Llc How To Start An Llc In Nevada Truic

1st Round Of Modified Business Tax Refunds Sent To Businesses In Nevada Pahrump Valley Times